Electric vehicle tax credits, rebates and other incentives

Federal Credit

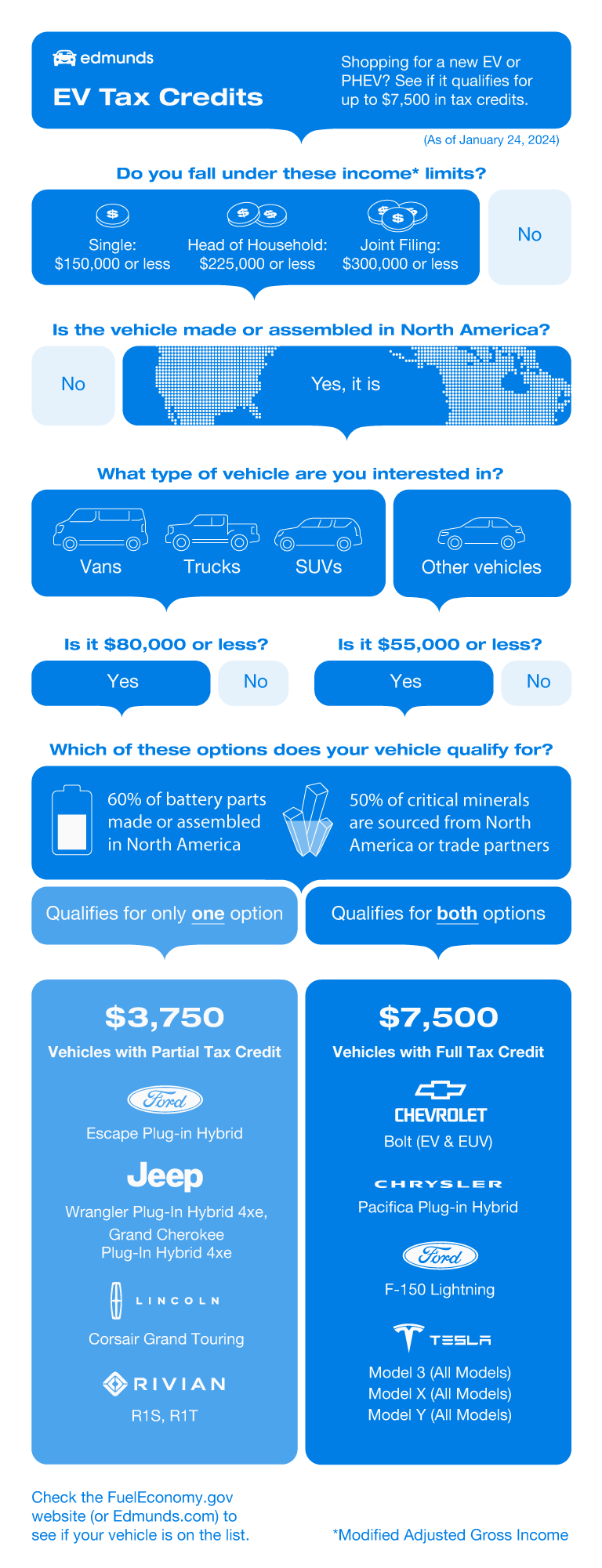

$7,500Maximum RebateUnder the Inflation Reduction Act of 2022, the Internal Revenue Service (IRS) offers taxpayers a Clean Vehicle Tax Credit of $3,750 or $7,500 depending on model eligibility for the purchase of a new plug-in electric vehicle. Beginning January 1, 2024, Clean Vehicle Tax Credits may be initiated and approved at the point of sale at participating dealerships registered with the IRS. Dealers will be responsible for submitting Clean Vehicle Tax Credit information to the IRS. Buyers are advised to obtain a copy of an IRS "time of sale" report, confirming it was submitted successfully by the dealer. To be eligible:

- A vehicle must have undergone final assembly in North America (the United States and Puerto Rico, Canada, or Mexico).

- Critical mineral and battery component requirements determine credit amount.

- Maximum MSRP of $55,000 for cars and $80,000 for SUVs/trucks/vans.

- Income eligibility applies depending on modified adjusted gross income (AGI) and tax filing status.

To learn more, visit https://www.irs.gov/credits-deductions/credits-for-new-clean-vehicles-purchased-in-2023-or-after

Conquest Offer

$3,000Maximum RebateCurrent owners/lessees of one of the qualifying vehicles (2011 model year or newer Acura, Audi, BMW, Ford, Honda, Hyundai, Infiniti, Jeep, Kia, Lexus, Lincoln, Mercedes-Benz, Toyota, Volvo, Porsche, Tesla, Genesis, Polestar, Rivian) are eligible to use this offer toward the purchase or lease of one of the new and unused models.. Trade-in Not Required. Cannot be combined with loyalty offers. Proof of qualifying vehicle required. See dealer for details.Loyalty Offer

$1,000Maximum RebateCustomers who currently lease a 2020 or newer or own a 2011 year or newer Cadillac passenger car or truck and purchase/lease one of the new and unused eligible models qualify for this offer. Proof of loyalty vehicle lease/own is required. Offer is transferable within the household. Can not be combined with conquest offers. See dealer for complete details.Educator Offer

$500Maximum RebateEmployees of any school, college or university (teachers, administrators, support staff) that are employed directly by the school, college or university (i.e. contract employees are not eligible) receive a cash allowance when they purchase/lease an eligible model. Proof of employment and authorization code required. May be incompatible with certain other incentive offers and/or employee/plan pricing. See dealer for details or visit www.gmeducatordiscount.com.First Responder Offer

$500Maximum RebateGeneral Motors First Responder Cash Allowance Program. Eligible customers which include firefighters, police, EMT/paramedics and 911 dispatch can use this allowance toward the purchase/lease of an eligible model. Proof of employment and authorization code required. See dealer for details or visit www.gmfirstresponderdiscount.com for complete eligibility details.Military Offer

$500Maximum RebateGM Military Discount Cash Allowance Program for active, reserve and retired military personnel, including discharged veterans within three years of discharge date, who purchase/lease an eligible model. Eligibility verified by ID.ME and authorization code required. See dealer for details or visit www.gmmilitarydiscount.com for complete eligibility detailsThird Party EV Charger Offer

$100Maximum RebateEdmunds is partnering with Treehouse, an independent provider of home EV installation services. Edmunds visitors receive a $100 discount when they contract with Treehouse for their home charger installation. Discount excludes permit, hosted inspection, and load management devices. Valid for 30 days.To learn more, visit https://treehouse.pro/edmundsdiscount/

Adaptive Equipment Allowance

This is the General Motors GM Accessibility Program. This program offers customers a reimbursement for an amount matching the actual cost of eligible adaptive accessibility equipment subject to maximum. See dealer for complete details.Affiliations, Clubs or Groups Offer

Customers who were Costco members as of June 02, 2025 or who become a Costco member at a Costco warehouse that opens after June 02, 2025 can use the allowance towards the purchase/lease one of the eligible models. Approval Code is required. Eligible Costco members should go to www.costcoauto.com. Offer is transferable within the household. Dealer will confirm eligibility. Can not be combined with some other offers. See dealer for details.

2025 Cadillac LYRIQ

$7,500Vehicle Rebates$100Charging Rebates+ more qualifying rebates2024 Cadillac LYRIQ

$7,500Vehicle Rebates$100Charging Rebates+ more qualifying rebates

Federal EV Tax Credits Overview

Federal EV Tax Credit Incentive #1: North American Final Assembly

Federal EV Tax Credit Incentive #2: Origin of Critical Battery Minerals ($3,750 Tax Credit)

Federal EV Tax Credit Incentive #3: Origin of Battery Components ($3,750 Tax Credit)

Federal EV Tax Credit Incentive #4: No Involvement by Blacklisted Countries After 2023

Federal EV Tax Credit Incentive #5: Price Limits

Federal EV Tax Credit Incentive #6: Buyer Income Limits

FAQ

EV Tax Credits Vehicle Eligibility

More EV News Articles

- Electric Vehicle Tax Credits: What You Need to KnowRonald Montoya•09/08/2022

- Best Electric Cars of 2022 and 2023Edmunds

- Edmunds' EV Buying GuideEdmunds•05/05/2022

- Cheapest Electric CarsEdmunds•03/22/2022

- The True Cost of Powering an Electric CarEdmunds•03/29/2022

- Home EV Charging 101Jonathan Elfalan•04/21/2021

- 2026 Nissan Leaf vs. Tesla Model Y vs. Chevy Equinox EV: Affordable EVs ComparedNick Yekikian•06/17/2025

- 2026 Kia EV4 First Drive Review: Tesla Defectors Look HereClint Simone•06/16/2025

- 2026 GMC Sierra EV AT4 First Drive: Taking the Electric Pickup Off-RoadJake Lingeman•06/10/2025

- VW ID Buzz vs. Kia EV9 vs. Volvo EX90: The All-Electric Three-Rows Have ArrivedBrian Wong•06/06/2025

- The Best Cars (Currently) Made in AmericaBrian Wong•05/23/2025