Electric vehicle tax credits, rebates and other incentives

Federal Credit

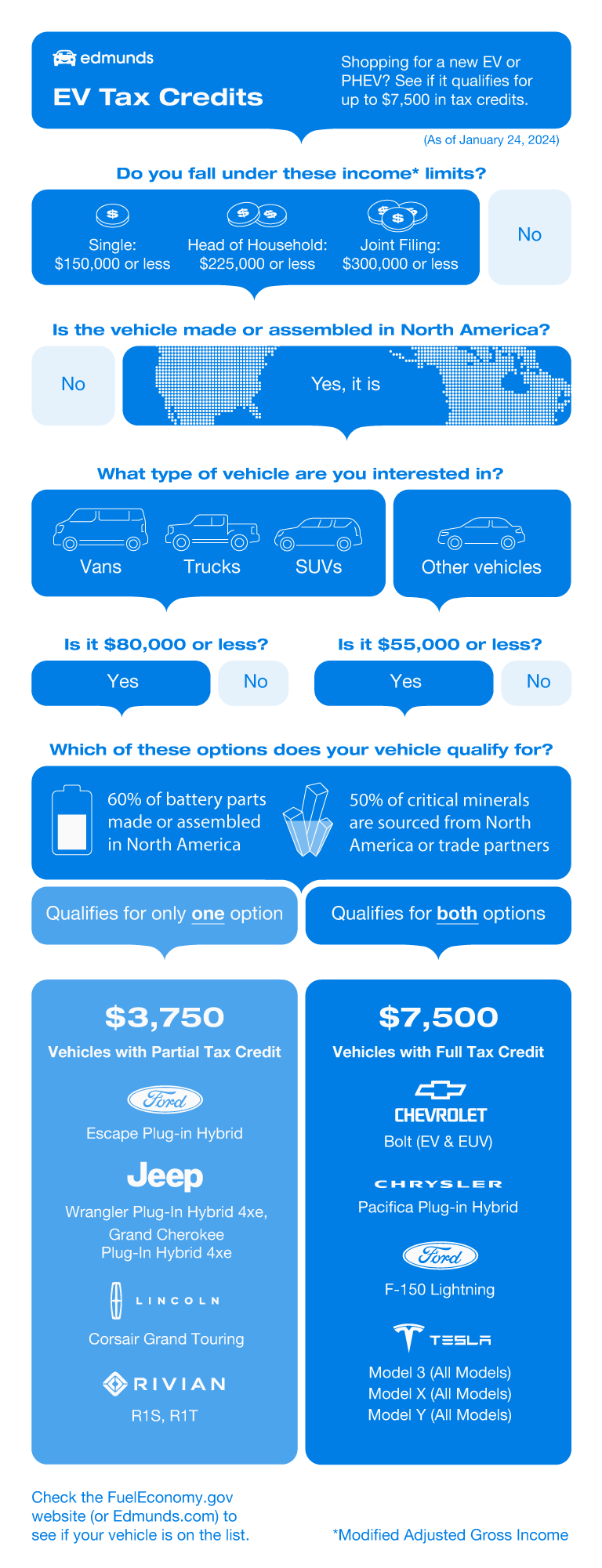

$7,500Maximum RebateUnder the Inflation Reduction Act of 2022, the Internal Revenue Service (IRS) offers taxpayers a Clean Vehicle Tax Credit of $3,750 or $7,500 depending on model eligibility for the purchase of a new plug-in electric vehicle. Beginning January 1, 2024, Clean Vehicle Tax Credits may be initiated and approved at the point of sale at participating dealerships registered with the IRS. Dealers will be responsible for submitting Clean Vehicle Tax Credit information to the IRS. Buyers are advised to obtain a copy of an IRS "time of sale" report, confirming it was submitted successfully by the dealer. To be eligible:

- A vehicle must have undergone final assembly in North America (the United States and Puerto Rico, Canada, or Mexico).

- Critical mineral and battery component requirements determine credit amount.

- Maximum MSRP of $55,000 for cars and $80,000 for SUVs/trucks/vans.

- Income eligibility applies depending on modified adjusted gross income (AGI) and tax filing status.

To learn more, visit https://www.irs.gov/credits-deductions/credits-for-new-clean-vehicles-purchased-in-2023-or-after

Customer Cash

$3,000Maximum RebateCustomer Cash from Kia America for the purchase of a new Kia. Customer Cash must be applied toward the purchase of a new Kia and not available for cash. Subject to vehicle availability and dealer participation. Offers may not be combined except where specified. Must take delivery by 07-07-2025. Limited inventory available. Offer not available for leases. See Kia retailer for available stock.Conquest Offer

$1,000Maximum RebateCustomers may receive $1000 on the purchase or lease of a new, eligible Kia vehicle from Kia America, Inc. (KUS) between 06/03/2025 - 07/07/2025 if they qualify for the Competitive Bonus Program. Contact your local Kia dealer for a listing of eligible qualifying competitor vehicles and complete details. Vehicles outside of those listed will be deemed ineligible and claim submissions will be rejected. To be eligible, customer must show proof of qualifying model year 2014-2026 competitor vehicle ownership (current registration) to Kia dealer where new, eligible Kia vehicle is being purchased. Void where prohibited by law. This incentive is a limited time offer on eligible Kia vehicles. Not all incentive programs are compatible. Additional terms and conditions apply. See your participating dealer for more details. All matters of program eligibility and qualification will be resolved by KUS in its sole discretion, and KUS reserves the right to change product and program specifications at any time without incurring any obligations. Offer valid from 06/03/2025 - 07/07/2025.Loyalty Offer

$1,000Maximum RebateOwner Loyalty Offer available to current Kia owners who purchase or lease a new Kia vehicle between 06-03-2025 - 07-07-2025. A customer can only qualify for Owner Loyalty Incentive claims for two purchases (2 VINs) per calendar year and the vehicle utilized as the qualifying vehicle may not be the same vehicle in both instances. Offer may be combined with Low APR, Lease, or Cash offers. To be eligible, new Kia vehicle purchaser must show proof of qualifying Kia vehicle ownership (current registration) to Kia dealer where new Kia vehicle is being purchased. Void where prohibited by law. This incentive is a limited time offer on eligible Kia vehicles and must be applied as down payment. No cash value. Not all incentive programs are compatible. Additional terms and conditions apply. See your participating dealer for more details. All matters of program eligibility and qualification will be resolved by by Kia America, Inc. ("KUS") in its sole discretion, and KUS reserves the right to change product and program specifications at any time without incurring any obligations. Offer valid from 06-03-2025 - 07-07-2025.Military Offer

$500Maximum RebateCustomers eligible for the Kia America, Inc. ("KUS") Military Specialty Incentive Program must be an active member of, honorably discharged from, retired from, or on disability with the United States Armed Forces or Reserves (includes those that have "national" status from another country and are serving in the United States military) or the spouse of the eligible participant. Eligible customers or his or her spouse must provide a copy of one of the following to a Kia dealer at the time of purchase: a current Earning Statement, a copy of the honorable discharge papers, a bank statement indicating a pension or disability earnings from the United States Armed Forces, or an official document indicating future pension eligibility. Military ID is not a sufficient form of proof of eligibility. If eligible customer is a spouse of participant, proof must be provided of the spousal status by providing proof of marriage (marriage certificate). Applies to new vehicles purchased or leased between 06-03-2025 - 07-07-2025. Customer is only eligible for a total of two (2) Specialty Incentives during a calendar year. This offer may be combined in addition to certain other incentives offered by KUS. See dealer for details. Not all incentive programs are compatible. This incentive is a limited time offer on eligible Kia vehicles. No cash value. Additional terms and conditions apply. See your participating dealer for more details. All matters of program eligibility and qualification will be resolved by KUS in its sole discretion, and KUS reserves the right to change product and program specifications at any time without incurring obligationsThird Party EV Charger Offer

$100Maximum RebateEdmunds is partnering with Treehouse, an independent provider of home EV installation services. Edmunds visitors receive a $100 discount when they contract with Treehouse for their home charger installation. Discount excludes permit, hosted inspection, and load management devices. Valid for 30 days.To learn more, visit https://treehouse.pro/edmundsdiscount/

2025 Kia EV6

$10,500Vehicle Rebates$100Charging Rebates+ more qualifying rebates2024 Kia EV6

$100Charging Rebates

Federal EV Tax Credits Overview

Federal EV Tax Credit Incentive #1: North American Final Assembly

Federal EV Tax Credit Incentive #2: Origin of Critical Battery Minerals ($3,750 Tax Credit)

Federal EV Tax Credit Incentive #3: Origin of Battery Components ($3,750 Tax Credit)

Federal EV Tax Credit Incentive #4: No Involvement by Blacklisted Countries After 2023

Federal EV Tax Credit Incentive #5: Price Limits

Federal EV Tax Credit Incentive #6: Buyer Income Limits

FAQ

EV Tax Credits Vehicle Eligibility

More EV News Articles

- Electric Vehicle Tax Credits: What You Need to KnowRonald Montoya•09/08/2022

- Best Electric Cars of 2022 and 2023Edmunds

- Edmunds' EV Buying GuideEdmunds•05/05/2022

- Cheapest Electric CarsEdmunds•03/22/2022

- The True Cost of Powering an Electric CarEdmunds•03/29/2022

- Home EV Charging 101Jonathan Elfalan•04/21/2021

- 2026 Nissan Leaf vs. Tesla Model Y vs. Chevy Equinox EV: Affordable EVs ComparedNick Yekikian•06/17/2025

- 2026 Kia EV4 First Drive Review: Tesla Defectors Look HereClint Simone•06/16/2025

- 2026 GMC Sierra EV AT4 First Drive: Taking the Electric Pickup Off-RoadJake Lingeman•06/10/2025

- VW ID Buzz vs. Kia EV9 vs. Volvo EX90: The All-Electric Three-Rows Have ArrivedBrian Wong•06/06/2025

- The Best Cars (Currently) Made in AmericaBrian Wong•05/23/2025