Electric vehicle tax credits, rebates and other incentives

Use this tool to find generally available and qualifying tax credits, incentives and rebates that may apply to your purchase or lease of an electric vehicle. You'll find the latest federal,… local municipality, utility and automaker-sponsored programs that can reduce the price of your next EV or PHEV. We’re constantly updating the list of available programs, so make sure to check back often for the latest opportunities.

2 results

Customer Bonus Cash

$10,500Maximum RebateCustomers purchasing select Volkswagen models may be eligible for bonus cash incentive. Cash Bonus is in lieu of VWFS special APR, See your Volkswagen retailer for complete details.Military and First Responders Offer

$500Maximum RebateActive Duty US Military and First Responders, US Military veterans (honorable discharge, within 24 months of active duty), and US Military Retirees (20 or more years of service) are eligible. Active duty US military branches include Army, Navy, Air Force, Marines, National Guard, Coast Guard, and Active Reserve. Active first responder occupations include: Police Officer, Sheriff/Sheriff's Deputy, Correctional Officer, State Trooper, Federal Law Enforcement Officer, Firefighter (career or volunteer), EMT, Paramedics, 911 Dispatcher/Operator. Ineligible Occupations: Retired First Responders, Registered Nurse, Ski Patrol, Community Emergency Response Team (CERT) members, Volunteers in Police Service (VIPS), Search and Rescue, Emergency Management Volunteers. Offer is transferable to family household members. Proof of residency and proof of service/occupation required. Only one bonus applicable per vehicle. Customers are eligible to purchase or lease up to 2 vehicles per calendar year through this program. See your Volkswagen retailer for complete program details.Student or College Grad Offer

$500Maximum RebateCollege Graduate Program available to qualified buyers who are within 6 months of graduation, or have graduated no more than 24 months prior to the date of credit application from one of the following: - a two or four year accredited college - an accredited Associate's, Bachelor's, Master's or Doctorate program - an accredited Registered Nursing or Licensed Practical Nursing School. Offer requires finance or lease through Volkswagen Financial serves. Other restrictions may apply, see your Volkswagen retailer for complete details.Third Party EV Charger Offer

$100Maximum RebateEdmunds is partnering with Treehouse, an independent provider of home EV installation services. Edmunds visitors receive a $100 discount when they contract with Treehouse for their home charger installation. Discount excludes permit, hosted inspection, and load management devices. Valid for 30 days.To learn more, visit https://treehouse.pro/edmundsdiscount/

Complimentary Charging Offer

This program is a charging agreement between Volkswagen of America and Electrify America. Customers who purchase a new 2025 Volkswagen ID.4 will receive 3 years of Pass+ pricing with 500 kWh of complimentary DC fast (CCS) and Level 2 charging on the Electrify America network. Promotion starts from the date of vehicle purchase. Offer is non-transferable. See your participating dealer for details.

2024 Volkswagen ID.4

$10,500Vehicle Rebates$100Charging Rebates+ more qualifying rebates2025 Volkswagen ID.4

$5,000Vehicle Rebates$100Charging Rebates+ more qualifying rebates

Showing 1 - 2 out of 2 results

Was this information helpful?

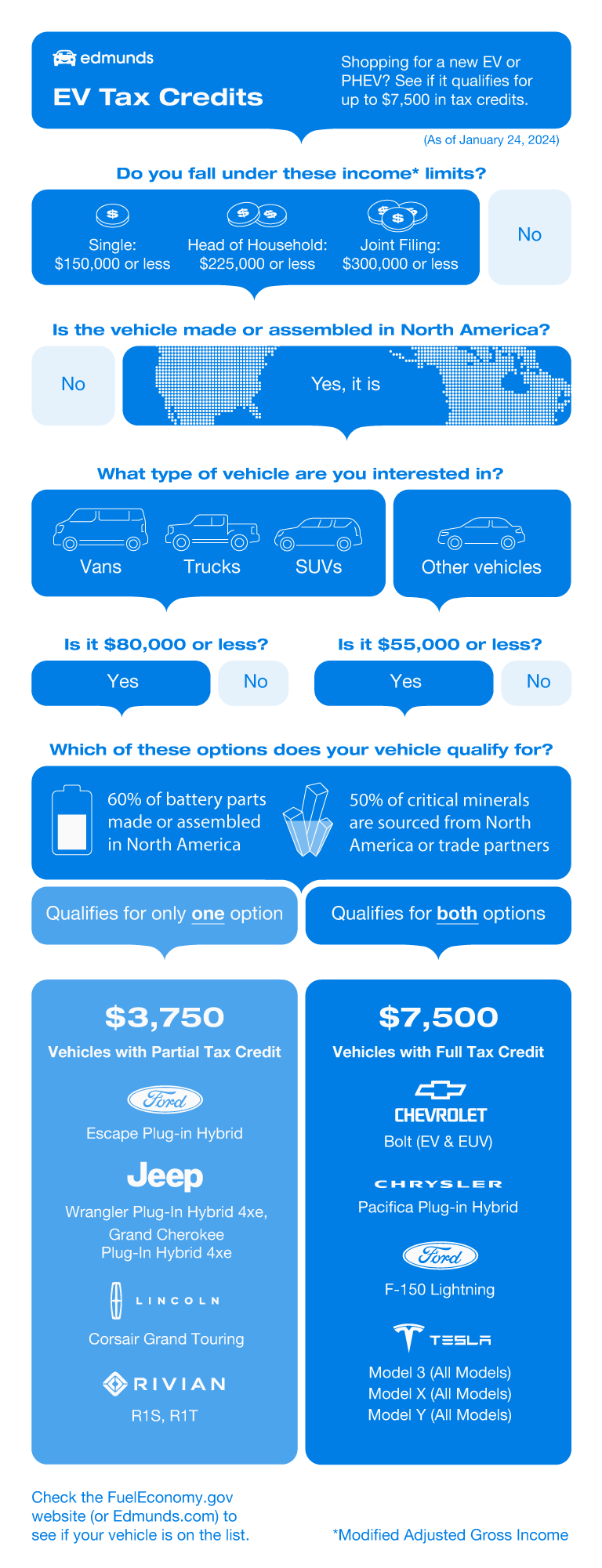

Federal EV Tax Credits Overview

Shopping for an electric vehicle (EV) or a plug-in hybrid electric vehicle (PHEV)? According to the landmark Inflation Reduction Act of August 2022, you can get up to $7,500 in tax credits if you purchase an EV or a PHEV, but it very much depends on the make and model you're considering. We'll give you the highlights here and encourage you to visit our in-depth analysis of the Inflation Reduction Act for full details. Additional incentives may be provided at the state and local levels, but our purpose here is to summarize federal EV tax incentives, not state and local incentives.

Federal EV Tax Credit Incentive #1: North American Final Assembly

You can't get any EV tax credits or PHEV tax credits unless the vehicle was assembled in North America, full stop. In the short run, this leaves some automakers out in the cold, but the idea is to create a new incentive to build clean vehicles right here on our home turf. Notably, meeting this final assembly requirement doesn't automatically mean you get a tax credit -- it just gets your foot in the door. Provided that the vehicle is assembled in North America, it may qualify for federal tax credits if further conditions are met. Specifically, the maximum $7,500 federal EV tax credit is made up of two separate $3,750 credits, one targeting EV battery minerals and the other EV battery components.

Federal EV Tax Credit Incentive #2: Origin of Critical Battery Minerals ($3,750 Tax Credit)

As with vehicle assembly, the U.S. government also wants to move the sourcing of critical battery minerals closer to home, at least in terms of trade partnerships. To this end, increasing percentages of critical EV battery minerals must be sourced from the U.S. itself or a U.S. free-trade partner, starting with 40% for 2023. The minimum percentage escalates quickly to 80% by 2027. Unless the EV or PHEV you purchase meets this requirement, you won't have access to at least half of the $7,500 maximum federal EV tax credit.

Federal EV Tax Credit Incentive #3: Origin of Battery Components ($3,750 Tax Credit)

Moving back to the assembly side, the U.S. likewise wants to incentivize the production of battery components at home or in free-trade partner countries. To enable this half of the $7,500 maximum tax credit for 2023, at least 50% of your vehicle's battery components must have been produced in the U.S. or in countries that have free-trade agreements with the U.S. Note that the minimum threshold escalates steadily to a full 100% by 2029, whereas the previous requirement regarding battery minerals stops (for now) at 80% in 2027.

Federal EV Tax Credit Incentive #4: No Involvement by Blacklisted Countries After 2023

Here's another one that's just about getting your foot in the door. In a not-so-subtle shot at China, which jumped out to a big lead in the EV battery business, the U.S. government has stipulated that once the calendar year flips to 2024, the EV or PHEV you purchase won't qualify for federal EV tax credits if any battery components came from a "foreign entity of concern," a short list that includes China, Russia, Iran and North Korea. For 2025, the stipulation will extend to critical battery minerals. Here again we can expect some short-term pain for automakers as they pivot from dependence on Chinese suppliers, but the financial incentives pushing that pivot are strong.

Federal EV Tax Credit Incentive #5: Price Limits

We use the plural because it depends on the type of vehicle you're considering. If it's an SUV, van, or pickup truck, it can't cost more than $80,000 or else it's not eligible for federal EV tax credits. For all other vehicle types, the eligibility limit drops to $55,000. The point of this incentive is to stimulate production of relatively affordable EVs as opposed to ultra-luxury models.

Federal EV Tax Credit Incentive #6: Buyer Income Limits

Finally, there's the question of how much money the buyer makes. Clearly the government wants to incentivize EV purchases within the middle class, because if you file your taxes as an individual, you won't qualify for federal EV tax credits unless you have a modified gross adjusted income (MAGI) of less than $150,000. If you file as head of household, that limit increases to $225,000, while joint filers can have a combined MAGI of up to $300,000.

FAQ

EV Tax Credits Vehicle Eligibility

More EV News Articles

- Electric Vehicle Tax Credits: What You Need to KnowRonald Montoya•09/08/2022

- Best Electric Cars of 2022 and 2023Edmunds

- Edmunds' EV Buying GuideEdmunds•05/05/2022

- Cheapest Electric CarsEdmunds•03/22/2022

- The True Cost of Powering an Electric CarEdmunds•03/29/2022

- Home EV Charging 101Jonathan Elfalan•04/21/2021

- 2026 Nissan Leaf vs. Tesla Model Y vs. Chevy Equinox EV: Affordable EVs ComparedNick Yekikian•06/17/2025

- 2026 Kia EV4 First Drive Review: Tesla Defectors Look HereClint Simone•06/16/2025

- 2026 GMC Sierra EV AT4 First Drive: Taking the Electric Pickup Off-RoadJake Lingeman•06/10/2025

- VW ID Buzz vs. Kia EV9 vs. Volvo EX90: The All-Electric Three-Rows Have ArrivedBrian Wong•06/06/2025

- The Best Cars (Currently) Made in AmericaBrian Wong•05/23/2025