Colorado electric vehicle tax credits, rebates and incentives

Customer Cash

$12,500Maximum RebateReceive a customer bonus when you purchase or lease a new Q4 e-tron 45 RWD/Q4 e-tron 55/Q4 Sportback e-tron 55, Q7 55, SQ8, SQ7, A3 Sedan 40/S3 Sedan, A5 Sportback 40/A5 Sportback 45/S5 Sportback, A6 Sedan 45/A6 Sedan 55, Q5 40/Q5 S line 45, Q5 S line 55 TFSI e quattro, Q5 Sportback S line 45, A4 Sedan 40/A4 Sedan 45/S4 Sedan, SQ5 Sportback, Q8 55, SQ5, S e-tron GT/RS e-tron GT performance, A8 55/S8, 2024 Audi Q5 S line 55 TFSI e quattro, e-tron GT, RS e-tron GT *Audi of America, Inc. will pay a $1,000 customer bonus when you purchase or lease a new, unused 2025 Audi Q4 e-tron 45 RWD/Q4 e-tron 55/Q4 Sportback e-tron 55; a $1,500 customer bonus when you purchase or lease a new, unused 2025 Audi Q7 55; a $2,000 customer bonus when you purchase or lease a new, unused 2025 Audi SQ8; a $2,500 customer bonus when you purchase or lease a new, unused 2025 Audi SQ7; a $3,000 customer bonus when you purchase or lease a new, unused 2025 Audi A3 Sedan 40/S3 Sedan, A5 Sportback 40/A5 Sportback 45/S5 Sportback, A6 Sedan 45/A6 Sedan 55, Q5 40/Q5 S line 45, Q5 S line 55 TFSI e quattro, Q5 Sportback S line 45; a $4,000 customer bonus when you purchase or lease a new, unused 2025 Audi A4 Sedan 40/A4 Sedan 45/S4 Sedan, SQ5 Sportback, Q8 55; a $5,000 customer bonus when you purchase or lease a new, unused 2025 Audi SQ5, S e-tron GT/RS e-tron GT performance; a $10,000 customer bonus when you purchase or lease a new, unused 2025 Audi A8 55/S8*, a $5,000 customer bonus when you purchase or lease a new, unused 2024 Audi Q5 S line 55 TFSI e quattro; a $7,500 customer bonus when you purchase or lease a new, unused 2024 Audi e-tron GT; a $12,500 customer bonus when you purchase or lease a new, unused 2024 Audi RS e-tron GT through participating dealers. Offer ends 04/30/2025. Customer bonus applied toward purchase or lease and is not redeemable for cash. Offer not valid in Puerto Rico. See your local Audi dealer or, for general product information, call 1-800-FOR-AUDI. 2025 Audi of America, Inc.Customer Cash

$11,000Maximum RebateCustomer Cash from Kia America for the purchase of a new Kia. Customer Cash must be applied toward the purchase of a new Kia and not available for cash. Subject to vehicle availability and dealer participation. Offers may not be combined except where specified. Must take delivery by 04-30-2025. Limited inventory available. Offer not available for leases. See Kia retailer for available stock.Customer Bonus Cash

$10,500Maximum RebateCustomers purchasing select Volkswagen models may be eligible for bonus cash incentive. Cash Bonus is in lieu of VWFS special APR, See your Volkswagen retailer for complete details.Customer Bonus Cash

$8,000Maximum RebateContact dealer for details. Must take delivery by 04/30/2025. (24CRA)Clean Vehicle Offer

$7,500Maximum RebateGM EV Bonus Cash is only available on select vehicle VINs not eligible for the IRA Clean Vehicle Federal Tax Credit. Not available with special finance or lease offers. Offer terms subject to change. See dealer for details.Clean Vehicle Offer

$7,500Maximum RebateEligible customers may receive rebate towards the purchase or finance on select vehicles. Residency restrictions apply.Customer Bonus Cash

$7,500Maximum RebateGenesis Retail Bonus Cash for customer that purchase a new Genesis model. Not compatible with subvented lease or APR programs.Customer Bonus Cash

$7,500Maximum RebateEligible customers may receive cash incentive. Cash incentive may be incompatible with certain finance types or other cash programs, based on individual program rules. Residency restrictions apply.Customer Cash

$7,500Maximum RebatePurchase Allowance applies to select MY24 and MY25 Volvo vehicles sold as a cash purchase or financed through Volvo Car Financial Services (VCFS), the Purchase Allowance is not combinable with vehicles sold with the Promotional APR Financing Rate through Volvo Car Financial Services (VCFS). Available to qualified customers that meet Volvo Car Financial Services (VCFS) credit standards at authorized Volvo Cars Retailers. Not everyone will qualify for credit approval. Advertised financing does not include taxes, title, registration, license, and other dealer fees. Car shown with optional equipment. All offers are subject to vehicle availability. Must take delivery of vehicle between April 01, 2025 and April 30, 2025. See your participating Volvo Cars Retailer for details.Customer Cash

$7,500Maximum RebateRetail customers may be eligible for cash incentive. Incentive may not be combined with NMAC Lease or Special APR financing. Residency restrictions apply.Customer Cash

$7,500Maximum RebateContact dealer for details. Must take delivery by 04/30/2025. (24CR1)Customer Cash

$7,500Maximum RebateContact dealer for details. Must take delivery by 04/30/2025. (24CR1)Federal Credit

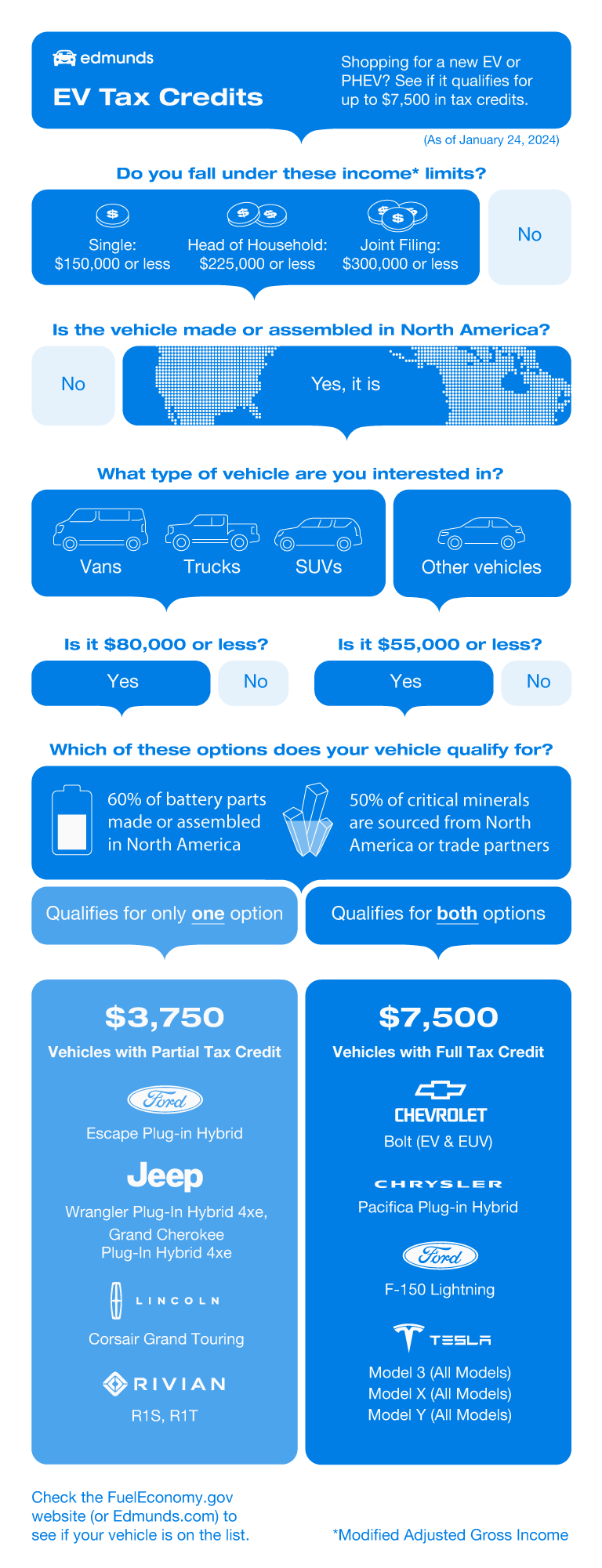

$7,500Maximum RebateUnder the Inflation Reduction Act of 2022, the Internal Revenue Service (IRS) offers taxpayers a Clean Vehicle Tax Credit of $3,750 or $7,500 depending on model eligibility for the purchase of a new plug-in electric vehicle. Beginning January 1, 2024, Clean Vehicle Tax Credits may be initiated and approved at the point of sale at participating dealerships registered with the IRS. Dealers will be responsible for submitting Clean Vehicle Tax Credit information to the IRS. Buyers are advised to obtain a copy of an IRS "time of sale" report, confirming it was submitted successfully by the dealer. To be eligible:

- A vehicle must have undergone final assembly in North America (the United States and Puerto Rico, Canada, or Mexico).

- Critical mineral and battery component requirements determine credit amount.

- Maximum MSRP of $55,000 for cars and $80,000 for SUVs/trucks/vans.

- Income eligibility applies depending on modified adjusted gross income (AGI) and tax filing status.

To learn more, visit https://www.irs.gov/credits-deductions/credits-for-new-clean-vehicles-purchased-in-2023-or-after

State Credit

$6,000Maximum RebateThe Colorado Department of Revenue offers the Innovative Motor Vehicle Tax Credit, up to $6,000 for the purchase of an eligible new all-electric, plug-in hybrid, or hydrogen fuel cell electric vehicle with a MSRP under $35,000. To qualify:

- Credit amounts for a qualifying vehicle beginning on or after 1/1/2025 but prior to 1/1/2026: $6,000.

- MSRP of vehicle including manufacturer installed optional equipment must be under $35,000.

- Gross Vehicle Weight Rating must be 8,500 lbs. or less.

- Motor vehicle must be titled and registered in Colorado to qualify for the credit.

- The motor vehicle must be new and not previously titled or registered in any jurisdiction.

Additional information:

- If utilizing at point-of-sale, an additional credit of $600 is allowed if assigning the entire allowable credit to a financing entity or motor vehicle dealer. An administration fee up to $250 may apply and reduce the total credit to $6,350.

To learn more, visit https://energyoffice.colorado.gov/transportation/grants-incentives/electric-vehicle-tax-credits

Vehicle Retirement Offer

$6,000Maximum RebateFunded by the Colorado Community Access Enterprise, the Vehicle Exchange Colorado (VXC) program offers $6,000 to income-eligible residents for the replacement of their old or high-emitting vehicles. Applicants with approval will receive this incentive at point-of-sale through participating authorized dealers for the purchase or lease of a qualified new Battery Electric Vehicle (BEV) or Plug-in Hybrid Electric Vehicle (PHEV). To qualify:

- Must complete a VXC rebate application and receive approval before rebates are issued.

- Income and household size must be below 80% of the area median income in an individual's county of residence.

- May qualify if showing proof of enrollment in eligible state or federal assistance programs.

- MSRP of new vehicle must be $80,000 or less.

- If leasing, lease term must be a minimum of two years.

- Model year of old or high-emitting gas or diesel vehicle must be at least 12 years old; if vehicle fails an emissions test in Colorado, no model year requirement.

- Vehicle must be currently titled and registered in Colorado without lien in the name of participant.

- Participant must be a Colorado resident, 18 years or older.

- Only one VXC rebate is allowed per tax household.

Additional information:

- Can be combined with Federal or State Tax Credits, but participant must verify combinability if applying for other EV offers for same vehicle purchase or lease.

For additional details and to apply, visit https://energyoffice.colorado.gov/vehicle-exchange-colorado

In Stock Inventory Offer

$5,500Maximum Rebate2024 Mach-E/Lightning VIN Specific Bonus Cash (#32578). Eligible buyers may receive 2024 Mach-E/Lightning VIN Specific Bonus Cash on select new vehicles. Incentive may be incompatible with certain finance types or other cash programs, based on individual program rules. Take new retail delivery from dealer stock by 07/07/2025. Residency restrictions apply. See dealer for qualifications and complete details.

2025 Jeep Wagoneer S

$23,500Vehicle Rebates$1,400Charging Rebates+ more qualifying rebates2024 Kia EV9

$20,500Vehicle Rebates$1,400Charging Rebates2025 Nissan LEAF

$20,500Vehicle Rebates$1,400Charging Rebates+ more qualifying rebates2024 Volkswagen ID.4

$20,000Vehicle Rebates$1,400Charging Rebates+ more qualifying rebates2024 Dodge Charger

$20,000Vehicle Rebates$1,400Charging Rebates+ more qualifying rebates2024 Jeep Wagoneer S

$20,000Vehicle Rebates$1,400Charging Rebates+ more qualifying rebates2025 Chevrolet Equinox EV

$19,500Vehicle Rebates$1,400Charging Rebates+ more qualifying rebates2024 Kia EV6

$19,500Vehicle Rebates$1,400Charging Rebates+ more qualifying rebates2025 Kia EV9

$19,500Vehicle Rebates$1,400Charging Rebates+ more qualifying rebates2024 Kia Niro EV

$18,000Vehicle Rebates$1,400Charging Rebates+ more qualifying rebates2024 Chevrolet Equinox EV

$17,000Vehicle Rebates$1,400Charging Rebates+ more qualifying rebates2024 Ford F-150 Lightning

$17,000Vehicle Rebates$1,400Charging Rebates+ more qualifying rebates2024 Hyundai IONIQ 6

$17,000Vehicle Rebates$1,400Charging Rebates+ more qualifying rebates2025 Tesla Cybertruck

$17,000Vehicle Rebates$100Charging Rebates2024 Acura ZDX

$17,000Vehicle Rebates$1,400Charging Rebates

Colorado electric car rebates: Everything you need to know

Colorado EV tax credits go as high as $8,000, but not for EVs you'd actually buy

At a glance, Colorado's $8,000 tax credit on heavy-duty electric trucks ($5,000 if you're leasing instead of buying) seems very generous. But wait a minute. What heavy-duty EV trucks can normal people even buy right now? The answer is that there's no such thing. Colorado defines a heavy-duty electric truck as having a gross vehicle weight rating (GVWR) of more than 26,000 pounds, which happens to be the threshold at which a commercial driver’s license is required. To put that in perspective, the gargantuan Hummer EV pickup truck, which weighs more than 9,000 pounds (nearly two tons more than a well-optioned Ford F-150), has a GVWR of just 10,550 pounds.

So much for that $8K tax credit, then, unless you are a highly specialized shopper with a commercial driver's license. Unfortunately, the next category down — medium-duty electric trucks — isn't exactly mainstream either. Colorado offers a $4,000 tax credit for buying one of these rigs ($2,500 if you're leasing), but the GVWR range is still way up there between 10,000 and 26,000 pounds. While it’s possible to qualify for the credit, you might have to buy a Hummer to do so.

Moving along to light-duty electric trucks, which are defined as having a GVWR between 8,500 and 10,000 pounds, we start to see more in the way of qualifying vehicles. The Rivian R1T is in that club; so is the Ford F-150 Lightning with the extended-range battery. The bad news is that light-duty electric trucks only get a $2,800 EV tax credit from Colorado, or $1,750 if you're leasing. But at least you've got multiple eligible models to choose from.

Trucks, trucks, trucks — what about regular cars and SUVs? Well, those contraptions are called "light-duty passenger vehicles" in Colorado's legislation, and they don't have any GVWR requirements. On the other hand, they also get the smallest EV tax credits of the bunch, checking in at $2,000 if you're buying and $1,500 if you're leasing. That's right: The category of electric vehicle that most people will be considering has the weakest incentives of all. It's better than nothing, but ordinary EV shoppers may wonder why Colorado doesn't seem more interested in incentivizing their purchases.

What about plug-in hybrid electric vehicles (PHEVs)?

Are there Colorado incentives for used EVs?

Can Colorado residents get any breaks on home charger installation?

What about federal EV tax credits?

EV Tax Credits Vehicle Eligibility

More EV News Articles

- Electric Vehicle Tax Credits: What You Need to KnowRonald Montoya•09/08/2022

- Best Electric Cars of 2022 and 2023Edmunds

- Edmunds' EV Buying GuideEdmunds•05/05/2022

- Cheapest Electric CarsEdmunds•03/22/2022

- The True Cost of Powering an Electric CarEdmunds•03/29/2022

- Home EV Charging 101Jonathan Elfalan•04/21/2021

- 2025 Chevy Blazer EV SS First Drive: The Only EV You'll Ever Need?Cameron Rogers•04/22/2025

- 2026 Kia EV9 Nightfall First Look: Back in BlackJosh Jacquot•04/16/2025

- 2026 Kia EV4 First Look: Funky Futuristic Electric SedanRyan Greger•04/16/2025

- Tesla Model Y vs. Equinox EV vs. Ioniq 5 vs. Prologue: Which Electric SUV Is Best?Brian Wong•04/11/2025

- We Bought a Dodge Charger Daytona EV — This Should Be InterestingClint Simone•04/03/2025