Massachusetts electric vehicle tax credits, rebates and incentives

State Rebate

$15,000Maximum RebateFunded by the Department of Energy Resources (DOER) under the Executive Office of Energy and Environmental Affairs, the MOR-EV Medium- and Heavy-Duty Vehicle Rebate provides a Voucher Block which varies from $10,838 up to $15,000 (200 vouchers per block). Rebates for eligible vehicles are reserved by applicants prior to purchase or lease through a voucher system. Check block status to see actual amount available. To qualify:

- Vehicle must be a Class 3 battery electric truck with a gross vehicle weight rating exceeding 10,000 lbs.

- Sales price must be $2,000,000 or less.

- Must be a resident of Massachusetts.

- Vehicles must be retained and registered in Massachusetts for at least 48 consecutive months beginning immediately after the vehicle purchase or lease.

- Leased vehicles are required to have lease terms of at least 48 months to be eligible for the program.

- Vehicles that have received incentive funds from other Massachusetts programs are not eligible.

Additional information:

- Voucher Block 1: First 200 vouchers receive $15,000.

- Voucher Block 2: Next 200 vouchers receive $12,750.

- Voucher Block 3: Last 200 vouchers receive $10,838.

- Check block level status to see actual amount available.

To learn more and apply, visit https://mor-ev.org/trucks-3-8

Customer Cash

$12,500Maximum RebateReceive a customer bonus when you purchase or lease a new Q4 e-tron 45 RWD/Q4 e-tron 55/Q4 Sportback e-tron 55, Q7 55, SQ8, SQ7, A3 Sedan 40/S3 Sedan, A5 Sportback 40/A5 Sportback 45/S5 Sportback, A6 Sedan 45/A6 Sedan 55, Q5 40/Q5 S line 45, Q5 S line 55 TFSI e quattro, Q5 Sportback S line 45, A4 Sedan 40/A4 Sedan 45/S4 Sedan, SQ5 Sportback, Q8 55, SQ5, S e-tron GT/RS e-tron GT performance, A8 55/S8, 2024 Audi Q5 S line 55 TFSI e quattro, e-tron GT, RS e-tron GT *Audi of America, Inc. will pay a $1,000 customer bonus when you purchase or lease a new, unused 2025 Audi Q4 e-tron 45 RWD/Q4 e-tron 55/Q4 Sportback e-tron 55; a $1,500 customer bonus when you purchase or lease a new, unused 2025 Audi Q7 55; a $2,000 customer bonus when you purchase or lease a new, unused 2025 Audi SQ8; a $2,500 customer bonus when you purchase or lease a new, unused 2025 Audi SQ7; a $3,000 customer bonus when you purchase or lease a new, unused 2025 Audi A3 Sedan 40/S3 Sedan, A5 Sportback 40/A5 Sportback 45/S5 Sportback, A6 Sedan 45/A6 Sedan 55, Q5 40/Q5 S line 45, Q5 S line 55 TFSI e quattro, Q5 Sportback S line 45; a $4,000 customer bonus when you purchase or lease a new, unused 2025 Audi A4 Sedan 40/A4 Sedan 45/S4 Sedan, SQ5 Sportback, Q8 55; a $5,000 customer bonus when you purchase or lease a new, unused 2025 Audi SQ5, S e-tron GT/RS e-tron GT performance; a $10,000 customer bonus when you purchase or lease a new, unused 2025 Audi A8 55/S8*, a $5,000 customer bonus when you purchase or lease a new, unused 2024 Audi Q5 S line 55 TFSI e quattro; a $7,500 customer bonus when you purchase or lease a new, unused 2024 Audi e-tron GT; a $12,500 customer bonus when you purchase or lease a new, unused 2024 Audi RS e-tron GT through participating dealers. Offer ends 04/30/2025. Customer bonus applied toward purchase or lease and is not redeemable for cash. Offer not valid in Puerto Rico. See your local Audi dealer or, for general product information, call 1-800-FOR-AUDI. 2025 Audi of America, Inc.Customer Cash

$11,000Maximum RebateCustomer Cash from Kia America for the purchase of a new Kia. Customer Cash must be applied toward the purchase of a new Kia and not available for cash. Subject to vehicle availability and dealer participation. Offers may not be combined except where specified. Must take delivery by 04-30-2025. Limited inventory available. Offer not available for leases. See Kia retailer for available stock.Customer Bonus Cash

$10,500Maximum RebateCustomers purchasing select Volkswagen models may be eligible for bonus cash incentive. Cash Bonus is in lieu of VWFS special APR, See your Volkswagen retailer for complete details.Customer Bonus Cash

$8,000Maximum RebateContact dealer for details. Must take delivery by 04/30/2025. (24CRA)Clean Vehicle Offer

$7,500Maximum RebateGM EV Bonus Cash is only available on select vehicle VINs not eligible for the IRA Clean Vehicle Federal Tax Credit. Not available with special finance or lease offers. Offer terms subject to change. See dealer for details.Clean Vehicle Offer

$7,500Maximum RebateEligible customers may receive rebate towards the purchase or finance on select vehicles. Residency restrictions apply.Customer Bonus Cash

$7,500Maximum RebateEligible customers may receive cash incentive. Cash incentive may be incompatible with certain finance types or other cash programs, based on individual program rules. Residency restrictions apply.Customer Bonus Cash

$7,500Maximum RebateGenesis Retail Bonus Cash for customer that purchase a new Genesis model. Not compatible with subvented lease or APR programs.Customer Cash

$7,500Maximum RebatePurchase Allowance applies to select MY24 and MY25 Volvo vehicles sold as a cash purchase or financed through Volvo Car Financial Services (VCFS), the Purchase Allowance is not combinable with vehicles sold with the Promotional APR Financing Rate through Volvo Car Financial Services (VCFS). Available to qualified customers that meet Volvo Car Financial Services (VCFS) credit standards at authorized Volvo Cars Retailers. Not everyone will qualify for credit approval. Advertised financing does not include taxes, title, registration, license, and other dealer fees. Car shown with optional equipment. All offers are subject to vehicle availability. Must take delivery of vehicle between April 01, 2025 and April 30, 2025. See your participating Volvo Cars Retailer for details.Customer Cash

$7,500Maximum RebateContact dealer for details. Must take delivery by 04/30/2025. (24CR1)Customer Cash

$7,500Maximum RebateRetail customers may be eligible for cash incentive. Incentive may not be combined with NMAC Lease or Special APR financing. Residency restrictions apply.Customer Cash

$7,500Maximum RebateContact dealer for details. Must take delivery by 04/30/2025. (24CR1)Federal Credit

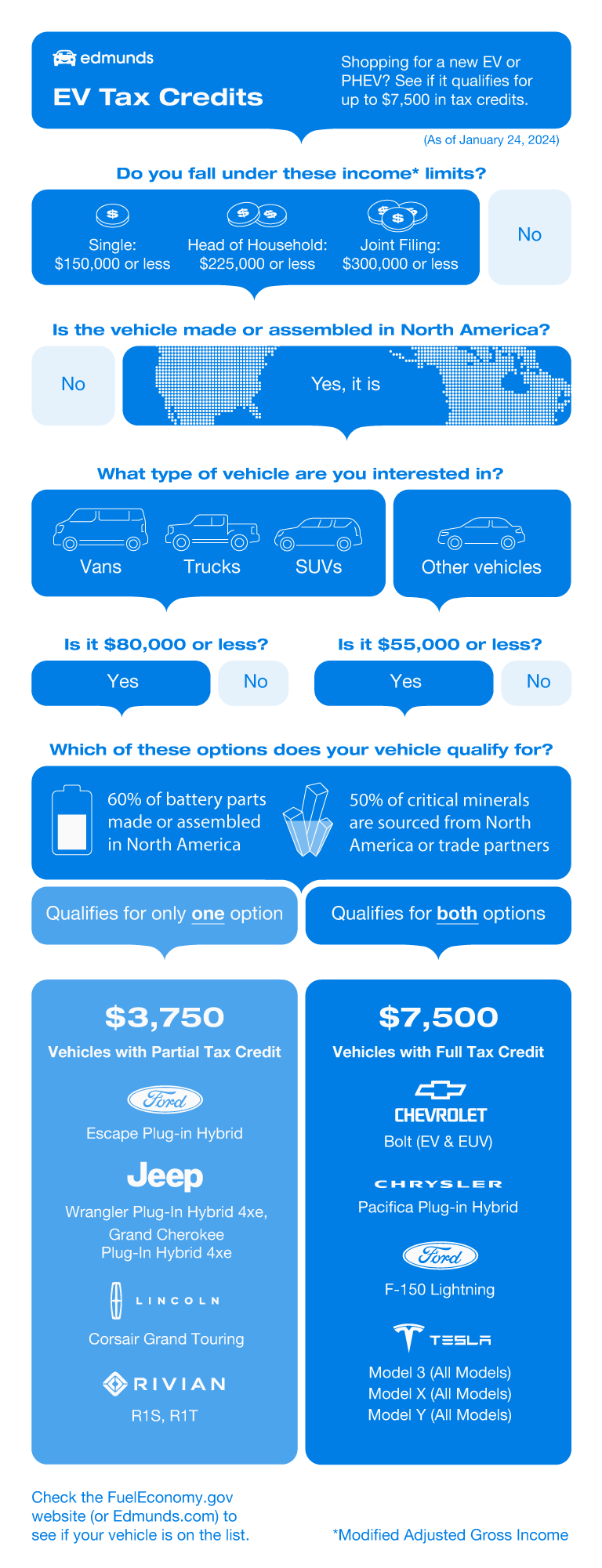

$7,500Maximum RebateUnder the Inflation Reduction Act of 2022, the Internal Revenue Service (IRS) offers taxpayers a Clean Vehicle Tax Credit of $3,750 or $7,500 depending on model eligibility for the purchase of a new plug-in electric vehicle. Beginning January 1, 2024, Clean Vehicle Tax Credits may be initiated and approved at the point of sale at participating dealerships registered with the IRS. Dealers will be responsible for submitting Clean Vehicle Tax Credit information to the IRS. Buyers are advised to obtain a copy of an IRS "time of sale" report, confirming it was submitted successfully by the dealer. To be eligible:

- A vehicle must have undergone final assembly in North America (the United States and Puerto Rico, Canada, or Mexico).

- Critical mineral and battery component requirements determine credit amount.

- Maximum MSRP of $55,000 for cars and $80,000 for SUVs/trucks/vans.

- Income eligibility applies depending on modified adjusted gross income (AGI) and tax filing status.

To learn more, visit https://www.irs.gov/credits-deductions/credits-for-new-clean-vehicles-purchased-in-2023-or-after

State EV Offer

$6,500Maximum RebateRide Clean Mass, funded by the Massachusetts Clean Energy Center, offers $6,500 to qualified Uber, Lyft, and taxi drivers for the purchase of a qualifying new battery electric or hydrogen fuel cell vehicle. Participants will apply to receive as a consumer-direct rebate after purchase of eligible vehicle. To qualify:

- Vehicle must be on the MOR-EV eligibility list (Vehicle sales price must be $55,000 or less).

- Vehicle must be purchased on or after November 12, 2024.

- Applicant must have a driver's license, car insurance, and show proof of Massachusetts residency.

- For Uber and Lyft drivers: Completed 400 rides in the last quarter, or driven 1,800 miles in the last quarter, as well as during three of the last four quarters.

- For taxi drivers: Own or lease a taxi medallion and hold a taxi license/permit.

Additional information:

- Eligible drivers who plan on renting a vehicle instead of purchasing may receive up to $100 per week for up to 4 weeks to help cover the cost of renting an EV. Rental weeks must be consecutive.

To learn more, visit Ride Clean Mass

In Stock Inventory Offer

$5,500Maximum Rebate2024 Mach-E/Lightning VIN Specific Bonus Cash (#32578). Eligible buyers may receive 2024 Mach-E/Lightning VIN Specific Bonus Cash on select new vehicles. Incentive may be incompatible with certain finance types or other cash programs, based on individual program rules. Take new retail delivery from dealer stock by 07/07/2025. Residency restrictions apply. See dealer for qualifications and complete details.

2024 Volkswagen ID.4

$23,000Vehicle Rebates$100Charging Rebates+ more qualifying rebates2024 Kia EV6

$22,500Vehicle Rebates$100Charging Rebates+ more qualifying rebates2025 Nissan LEAF

$21,000Vehicle Rebates$100Charging Rebates+ more qualifying rebates2024 Kia Niro EV

$21,000Vehicle Rebates$100Charging Rebates+ more qualifying rebates2024 Chevrolet Equinox EV

$20,000Vehicle Rebates$100Charging Rebates+ more qualifying rebates2024 Hyundai IONIQ 6

$20,000Vehicle Rebates$100Charging Rebates+ more qualifying rebates2025 Cadillac OPTIQ

$20,000Vehicle Rebates$100Charging Rebates+ more qualifying rebates2025 Chevrolet Equinox EV

$20,000Vehicle Rebates$100Charging Rebates+ more qualifying rebates2024 Honda Prologue

$20,000Vehicle Rebates$100Charging Rebates2025 Tesla Model 3

$20,000Vehicle Rebates$100Charging Rebates2024 Volvo XC40 Recharge

$20,000Vehicle Rebates$100Charging Rebates+ more qualifying rebates2025 Tesla Model Y

$20,000Vehicle Rebates$100Charging Rebates2025 Kia Niro EV

$20,000Vehicle Rebates$100Charging Rebates+ more qualifying rebates2024 Chevrolet Blazer EV

$20,000Vehicle Rebates$100Charging Rebates+ more qualifying rebates2025 Hyundai IONIQ 6

$20,000Vehicle Rebates$100Charging Rebates+ more qualifying rebates

Massachusetts electric car rebates: Everything you need to know

MOR-EV program provides up to $3,500 cash back on EV purchases

The first thing to know is that if you're buying or leasing a new electric vehicle or fuel cell electric vehicle (FCEV) in Massachusetts that costs less than $55,000, you should be able to score a $3,500 rebate from the Massachusetts Offers Rebates for Electric Vehicles (MOR-EV) program. Just make sure you check MOR-EV's list of eligible vehicles to verify that your ride of choice is included.

The $55,000 ceiling may seem a bit low given that the federal government has an $80,000 ceiling for electric SUVs and trucks and applies its $55,000 ceiling only to electric cars. In effect, the Massachusetts government is saying it doesn't want to incentivize the purchase of luxury electric vehicles. Rather, it wants to focus on mainstream models that have a better chance of widespread adoption.

There is also no income ceiling for the $3,500 rebate, while the federal government's EV rebates have specific income limits that govern buyer eligibility. So you can get that $3,500 kickback in Massachusetts no matter how much you make — you just can't get it on a Lucid or a Rivian or any other fancy-pants electric vehicle that costs north of $55K.

What about plug-in hybrid electric vehicles (PHEVs)?

Are there Massachusetts incentives for used EVs?

Can Massachusetts residents get any breaks on home charger installation?

What about federal EV tax credits?

EV Tax Credits Vehicle Eligibility

More EV News Articles

- Electric Vehicle Tax Credits: What You Need to KnowRonald Montoya•09/08/2022

- Best Electric Cars of 2022 and 2023Edmunds

- Edmunds' EV Buying GuideEdmunds•05/05/2022

- Cheapest Electric CarsEdmunds•03/22/2022

- The True Cost of Powering an Electric CarEdmunds•03/29/2022

- Home EV Charging 101Jonathan Elfalan•04/21/2021

- 2025 Chevy Blazer EV SS First Drive: The Only EV You'll Ever Need?Cameron Rogers•04/22/2025

- 2026 Kia EV9 Nightfall First Look: Back in BlackJosh Jacquot•04/16/2025

- 2026 Kia EV4 First Look: Funky Futuristic Electric SedanRyan Greger•04/16/2025

- Tesla Model Y vs. Equinox EV vs. Ioniq 5 vs. Prologue: Which Electric SUV Is Best?Brian Wong•04/11/2025

- We Bought a Dodge Charger Daytona EV — This Should Be InterestingClint Simone•04/03/2025