- New vehicle purchases continue to grow increasingly out of reach for consumers as interest rates remain elevated.

- The $20,000 new vehicle is nearly extinct, and the $25,000 new vehicle is next in line.

- 94% of large SUVs sold in February were over $60,000, compared to 59% five years ago.

- Incentive programs are likely to play a larger role as inventory has improved industry-wide following the semiconductor-induced shortage.

Where Did All the Cheap Cars Go?

We dug into the numbers to find out

Affordability is a growing issue for everyday Americans trying to buy new vehicles. According to Edmunds data, the average transaction price (ATP) for a new vehicle was $47,060 in February 2024.

The new market didn’t always look this way — five years ago, the average new vehicle transaction price was $36,677, which translates to a 28% spike in just five years. And there were more options available to consumers at lower price points. In fact, when gas prices climbed in 2008, Detroit automakers scrambled to make smaller, more fuel-efficient vehicles after being criticized for losing touch with what Americans needed. But consumer preferences didn’t take too long to shift back in the other direction.

Over the last decade, low interest rates combined with longer loan terms allowed Americans to embrace the "bigger is better" mentality and buy larger, more richly equipped trucks and SUVs that dominate the roads and driveways across the country today as small vehicles are going extinct. But now that interest rates have shot up, and without many new vehicle options left on the lower end of the price spectrum, buying a new vehicle has become a challenge for many consumers. In fact, it’s shocking how few vehicles are purchased at “affordable” prices.

The disappearance of the $20,000 new vehicle

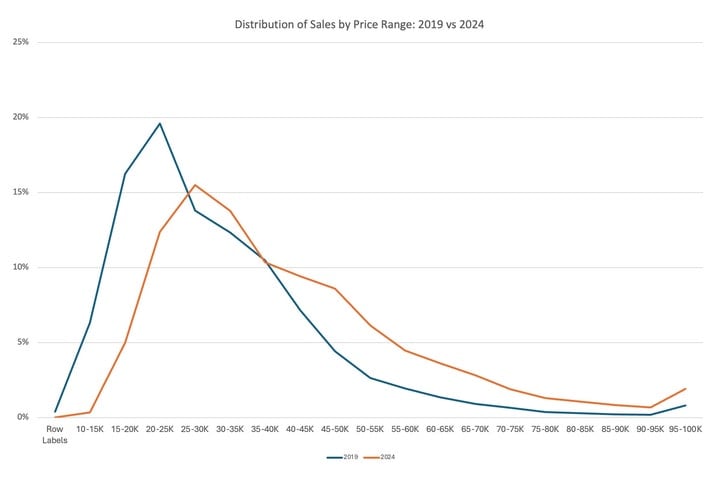

According to Edmunds transaction data from February 2024 compared to February 2019:

- 0.4% of new vehicles sold were $20,000 or under, compared to 7% five years ago.

- Just 5% of new vehicles sold were $25,000 or under, compared to 23% five years ago.

- 18% of new vehicles sold were under $30,000 compared to 43% five years ago.

The rise of the $60,000 new vehicle

For the past decade, automakers have been responding to consumer preferences and market demands, which meant that larger vehicle sizes, more features, and flashier technology and prices have increased accordingly. Edmunds transaction data from February 2024 compared to February 2019 reveals:

- 15% of vehicles sold were $60,000-plus compared to 5% five years ago.

- 11% of vehicles sold were $70,000-plus compared to 3% five years ago.

Large vehicles move into higher price brackets en masse

Edmunds transaction data from February 2024 compared to February 2019 shows:

- 50% of full-size trucks sold were over $60,000, compared to 8% five years ago.

- 94% of large SUVs sold were over $60,000, compared to 59% five years ago.

- 74% of luxury midsize SUVs sold were over $60K, compared to 37% five years ago.

Consumers forced to shift gears as credit anxiety rises

With low rates much less available to enable higher-dollar purchases, demand has grown for lower-priced vehicles. American car shoppers may not have the same enthusiasm for them as much as their bigger, flashier counterparts — but they will find that these options are what’s actually financially feasible in today's credit environment. Shoppers who refuse to compromise on size and price will need to pivot to used options for their next vehicle unless they can identify a new vehicle with an incentive program that brings the new-car smell back into their budget.

Edmunds says

Although used pricing has fallen from its peak, demand for used vehicles continues to be strong as new vehicles have simply grown out of reach for many Americans. Consumers jumping into the secondhand market for the first time need to keep in mind that interest rates for used vehicles are typically higher than for their new counterparts — and it’s critical to think beyond the monthly payment and take total costs into consideration over the life of the auto loan.

by

by