- Average trade-in ages for new and used vehicle purchases are on the rise, indicating that a growing share of buyers who sat out the market over the last few years are finally making a return.

- Used cars are flying off dealer lots at record rates as cooling used vehicle prices entice consumers.

- Buyers with trade-ins are leveraging the equity in their vehicles to make more expensive purchases.

They’re Back: Holdout Car Buyers Return to Showrooms in Droves in Q1

Widening gap in new and used vehicle prices pushes more shoppers to used

A growing share of buyers who sat out the last few years are returning to both the new and used car markets. The reason behind this dramatic comeback? An enticing combination of increased new vehicle supply and cooling prices has drawn stubborn consumers back into showrooms after years of hibernation.

The backstory

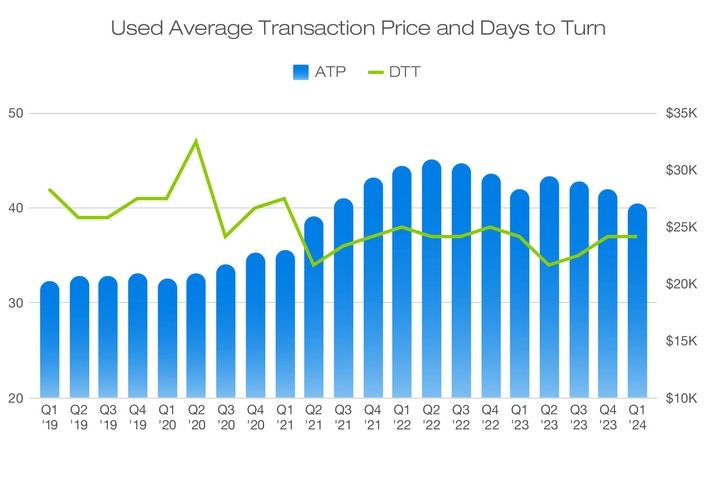

Pricing in the new car market plateaued in Q4 2023 at $48,056 and dropped to $46,992 for Q1 2024, marking the first time that average transaction prices (ATPs) fell below $47,000 since Q2 2022. Despite the drop in prices, new vehicles are sitting on dealer lots for longer: According to Edmunds data, days to turn — the number of days a vehicle sits on a dealership lot before being sold — climbed to 52 days in Q1, marking the sixth quarter-over-quarter increase in a row. These increased lot times, paired with ATP reductions, are also placing downward pressure on used values.

The used market posted a $27,113 average transaction price in Q1, which is down 4.5% from last year’s $28,381, but still up 33.9% from 2019’s $20,247. The steady trend toward reduced used vehicle values paired with historically low days-to-turn indicates that price reductions are resonating with consumers. The average days to turn for used vehicles dropped to 37 days in Q1 2024 (the same as in Q1 2023), whereas days to turn for new vehicles increased from 35 days in Q1 2023 to 52 days in Q1 2024.

Older trade-in ages mean that everyone is back

How do we know that consumers have made a return en masse? Look no further than an increase in average trade-in ages.

In 2022, new car inventory constraints forced many would-be buyers with prospective older trade-in vehicles to sit out the market and even had some traditional new-car buyers resorting to used. But as 2024 resembles a more familiar market, trade-ins of older vehicles have begun to return.

In Q1 2024, the average trade-in age for new vehicles climbed to 6.1 years compared to 5.3 years in Q1 2022. The average trade-in age for used vehicles increased to 9.4 years in Q1 2024, compared to 7.9 years in Q1 2022.

Average Vehicle Trade-In Age (In Years) by Quarter

Quarter | Overall Industry | New | Used |

|---|---|---|---|

| Q1 2019 | 7.6 | 6.3 | 9.5 |

| Q1 2020 | 7.5 | 6.1 | 9.5 |

| Q1 2021 | 7.3 | 6.0 | 9.3 |

| Q1 2022 | 6.4 | 5.3 | 7.9 |

| Q1 2023 | 7.1 | 5.8 | 8.9 |

| Q1 2024 | 7.3 | 6.1 | 9.4 |

Let’s dig deeper to better understand how a broader return of consumers is reshaping the market.

The used market gets a boost of older, more affordable vehicles

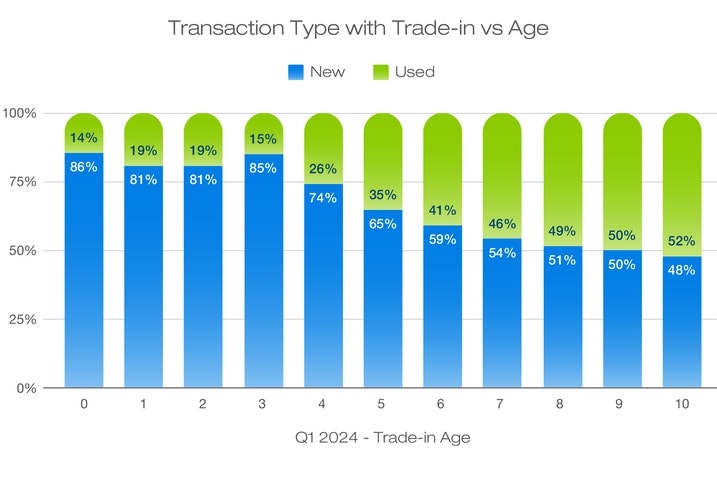

The return of holdout buyers should help bolster the supply of more affordable, older used vehicles. In Q1 2024, new car transactions had a trade-in 49% of the time on average, while used had a trade-in 31% of the time on average.

Within this pool of trade-ins, we’re also seeing that the consumers with older trade-in vehicles have a preference for buying a newer used vehicle instead of an outright new one. Right around the vehicle trade-in age of 9 years, we observed a perfect 50/50 split in customers either buying a new vehicle or buying a newer used vehicle. Vehicles older than 9 years were more likely to be traded in for a used vehicle.

Buyers with trade-ins boost ATPs

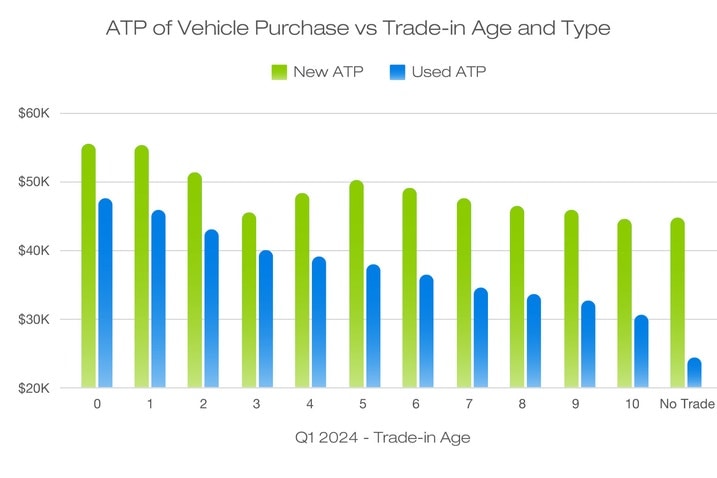

Transactions involving trades brought more money to the table for dealers and automakers in multiple ways. During Q1 2024, new vehicle sales that involved a trade-in had an average ATP of $47,549, while transactions without a trade-in averaged $45,192, a $2,357 difference.

Sales of used vehicles during Q1 2024 that involved a trade-in had an average transaction price of $32,709, compared to ones without a trade-in at $25,680, a $7,030 difference. And purchases involving older trade-ins had a direct correlation with a lower average transaction price.

Edmunds says

Consumers making their way back into the market after a number of years away are likely experiencing some sticker shock when shopping for new vehicles and therefore more thoroughly evaluating their purchase options. But the majority of new vehicles are far less likely to appeal to these buyers — they’ve waited for years to make a move, and are likely a bit more price-sensitive than the consumers who were willing to pay above MSRP at the height of the shortages.

Until new car incentives make a real comeback, used vehicles will continue to offer what new vehicles cannot: affordable transportation.

by

by  edited by

edited by